Introduction

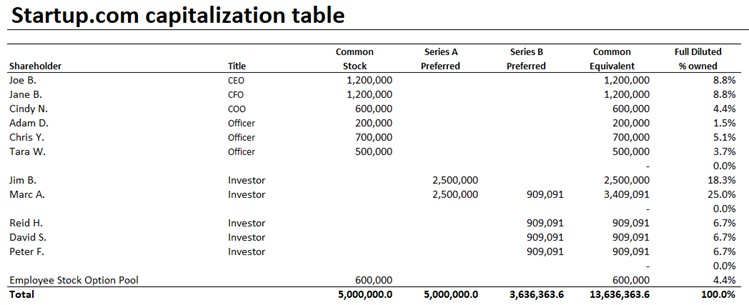

For Australian startups, managing a cap table (capitalisation table) isn’t just administrative housekeeping—it’s a strategic cornerstone. A well-structured cap table clarifies ownership, attracts investors, and ensures compliance with local regulations. In this guide, we’ll explore how to manage cap table challenges, align with investor expectations, and avoid pitfalls unique to Australia’s startup ecosystem.

Why Cap Table Management is Crucial for Startups

A cap table is a living document that tracks equity ownership, stock options, and convertible securities. Poorly managed cap tables can derail funding rounds, trigger legal disputes, or dilute founders unfairly. For Australian startups, precision here ensures:

- Investor Confidence: Clear records build trust.

- Scalability: Simplifies future funding rounds (e.g., Series A or exits).

- Compliance: Meets ASIC reporting standards and tax obligations.

Deep Insights into Cap Table Management

Start Early, Update Often

Begin with a simple spreadsheet but transition to cap table software (e.g., Cake Equity) as you grow. Track every transaction, including SAFE notes, ESOPs, and convertible loans.

Model Scenarios

Simulate dilution impacts from future funding rounds or employee stock grants. Tools like Carta help visualise ownership changes and prepare for negotiations with investors.

Transparency is Key

Share high-level summaries with stakeholders. Investors and employees appreciate clarity on their stake, so ensure that equity allocations are well-documented and communicated.

Investor Perspectives: What Australian Backers Expect

Local investors scrutinise cap tables to assess risk and alignment. They look for:

- Clean Structure: Minimal fragmentation (avoid 50+ shareholders).

- Dilution Safeguards: Anti-dilution clauses or pre-emptive rights.

- Exit Readiness: Clear path to liquidity (e.g., IPO or acquisition).

Pro tip: Highlight ESOP reserves (10–15%) to show you’re incentivising talent—a priority for popular Aussie VCs like Blackbird Ventures and Square Peg Capital.

Common Pitfalls of Managing Large Cap Tables

Overcomplication

Too many small investors (e.g., crowdfunding backers) complicate decision-making and investor negotiations.

Poor Record-Keeping

Manual errors and inconsistent record-keeping can lead to disputes during due diligence, delaying crucial investment rounds.

Ignoring Dilution

Founders can lose control of their startup after multiple funding rounds. Example: A startup founder starts with 70% ownership but finds themselves with only a 20% stake post-Series B, limiting strategic control.

Best Strategies to Manage Cap Table Structure

Simplify Early

Limit equity grants to essential stakeholders and use vesting schedules (typically four years with a one-year cliff) to align long-term commitment.

Reserve Equity

Allocate 10–20% for ESOPs and future hires. ASX-listed startups often use employee share schemes (ESS) to access tax advantages while incentivising talent.

Adopt Standardised Tools

Leverage cloud-based cap table management platforms to maintain real-time updates and compliance with Australian accounting standards. Popular options include:

- Cake Equity (Australian-focused platform)

- Carta (global leader)

- Pulley (great for scenario modelling)

Legal Considerations Specific to Australia

ASIC Compliance

- Report changes in shareholder structure promptly.

- Private companies must cap non-employee shareholders at 50.

- Any issuance of new shares must comply with ASIC regulatory filings.

Tax Implications

- Employee Shares: The Tax Assessment Act 1997 offers tax-deferred options under an ESS.

- Capital Gains Tax (CGT): Share sales trigger CGT, so structure exits wisely to optimise tax outcomes.

Shareholder Agreements

A well-drafted shareholder agreement prevents disputes. Include clauses for:

- Voting rights

- Drag-along and tag-along rights

- Exit provisions

Court cases in the NSW Supreme Court have shown that vague agreements lead to prolonged legal battles.

How to Use an ESOP Effectively

An Employee Share Option Plan (ESOP) aligns employee incentives with long-term company goals. Best practices include:

- Setting aside 10–15% of total equity.

- Defining clear vesting periods (4 years with a 1-year cliff).

- Ensuring compliance with ATO tax rulings for employee benefit optimisation.

Example: Australian unicorn Canva attributes much of its talent retention success to a well-structured ESOP.

Using a Digital Cap Table Platform vs. Spreadsheets

Relying on spreadsheets to track equity can seem like a simple and cost-effective solution, but as your business scales, it quickly becomes inefficient and risky. Manually managing cap tables, share allocations, and investor records can lead to several critical issues, including:

- Errors in Ownership Calculations – As new investors come on board, employees exercise stock options, and rounds of funding take place, maintaining accurate ownership percentages in a spreadsheet becomes increasingly complex. A small formula error or misplaced decimal can create significant discrepancies, leading to potential legal and financial complications.

- Lost Records or Discrepancies – Spreadsheets lack proper version control, making it difficult to track changes over time. A simple mistake—such as deleting a row or overwriting a past entry—can result in lost historical data. Without a clear audit trail, resolving discrepancies can be time-consuming and frustrating.

- Investor Mistrust Due to Inconsistent Data – Investors expect transparency and accuracy when reviewing a company’s cap table. If they receive conflicting information due to outdated or miscalculated spreadsheet data, it can lead to scepticism, delays in funding, and even loss of investor confidence.

Beyond these challenges, spreadsheets lack automation, integration, and security features that modern equity management platforms provide. Using a dedicated cap table management tool ensures accuracy, compliance, and a smoother experience for founders, investors, and legal teams alike.

Digital Tools to Consider

| Feature | Spreadsheets | Cap Table Software (e.g., Cake Equity) |

|---|---|---|

| Real-time updates | ❌ | ✅ |

| Scenario modelling | ❌ | ✅ |

| Legal compliance | ❌ | ✅ |

| Investor-friendly | ❌ | ✅ |

Final Thoughts

Managing your cap table effectively is essential for securing investment, maintaining control, and ensuring compliance with Australian regulations. By leveraging the right tools, planning for future growth, and seeking expert legal advice, you can build a cap table that supports your startup’s success.

At Allied Legal, we specialise in helping startups structure their cap tables, navigate funding rounds, and stay compliant with corporate laws. If you need expert guidance, reach out to our team—we’re here to help you scale with confidence.