There are multiple investment pathways founders can take when raising capital to accelerate growth. Seed financing, for example, can be useful for early-stage startups, particularly those in the research or product development stages of their venture. Seed funding or ‘seed capital’ requires an investor to provide capital in exchange for equity interest in a startup. Initially, these investors are typically family members, friends or angel investors. Angel investors are crucial players in seed financing, as they have the capacity to provide substantial capital and are more likely to take a chance on new ventures.

From an investment standpoint, seed financing is one of the riskiest forms of investing as investors are valuing a startup based on projections rather than profit. Due to this, venture capitalists (VC’s) often avoid seed financing in the initial rounds.

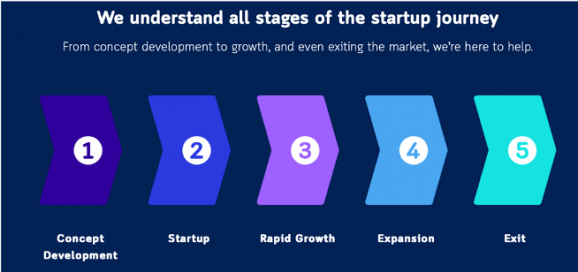

In seed financing there are a few key stages or ‘rounds’ in which founders generate capital. Depending on the scale of the venture, founders may feel that only one ‘seed round’ is necessary, where others may require multiple.

Here are the rounds usually involved in seed financing:

- Seed Round: this stage relates to ground floor operations such as determining market fit or researching and developing your startup’s offering. Funding can be raised by approaching your immediate circle before moving to angel investors.

- Series A: relates to the first round of shares proposed to angel investors or early-stage venture capitalists. During this stage you will need to prove to financiers why your startup is worth the investment by optimising your offering and business model.

- Series B: founders use financial backing to scale their startup and build traction. Success during this stage is reliant on your ability to prove that your startup is making a profit. Increased funding is usually used for business development, marketing and startup sales.

- Series C & Onwards: all subsequent funding rounds are used to scale your startup. Commonly, startups will stop at Series C of funding.

Overall, the process can be demanding as you will be required to prove your startup’s growth at every new stage or series. Additionally, you may be required to vary your agreement or equity stake depending on the investor and stage of seed funding. However, seed funding can also be a great way for startups to develop their offering and accelerate their growth.

Need Help? Contact Us

At Allied Legal we deal with startups and investors on a daily basis. If you need assistance preparing your relevant agreements, we are the ones to contact. If you would like to learn more about how we can help, give us a call on 03 8691 3111 or send us an email at hello@alliedlegal.com.au.

You might also like our article What Investors Focus on When Funding Early-Stage Ventures