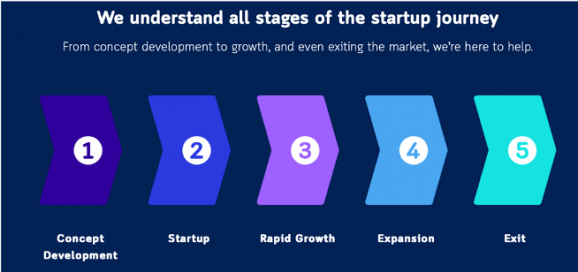

At Allied Legal we regularly advise on founder vesting arrangements and prepare related founder vesting agreements. Founding vesting agreements are common place in the startup world. But why are they required?

Well, startups rarely go perfectly to plan. Things can go wrong for many reasons resulting in founding teams splitting up. The chances of this are often increased where you have large founding teams formed in a short period of time. The risk is even greater when the team hasn’t really worked together before. Regardless of the size of your team and the likelihood of a founder fallout, how big an impact such a split has on your startup can make or break it. This is where vesting comes in.

One of the primary drivers behind the idea of vesting is to help reduce the impact of a co-founder leaving by ensuring they don’t leave with a disproportionate amount of equity. How this often works is that founder shares vest over time. By way of example, if you have a straight-line vesting schedule in place over 4 years and you started vesting 3 years ago, then you will have vested 75% of the shares allocated to you (with 25% unvested).

Vesting helps ensure that should a co-founder leave during the vesting period, there is enough equity left in the company to adequately incentivise the remaining founders and team. This is even more important when you think that the company will likely have to hire someone to replace the departing co-founder and that new hire will likely want some equity for their services. Founder vesting helps protect against a potentially catastrophic impact of a founder fallout situation for all stakeholders (founders and investors).

In the context of fundraising, especially in early-stage rounds, you’ll normally find investors resetting founder vesting regimes. This is because the commitment of the founders at this stage is absolutely critical to the success of the startup and so investors use founder vesting regimes to commit founders to the company. In such cases investors usually require a founder vesting regime of 12 – 24 months depending on the specific circumstances of the fundraising. However, such regimes can also result in unfairness where a founder is required to leave the startup due to some misfortune such as illness, injury or death. Accordingly, a founder who has to leave in such circumstances is generally regarded as a so-called “Good Leaver” which means the founder can retain the equity as compensation for the effort they’ve expended up until that point.

The other scenario worth mentioning is an acquisition of the startup company, in which case founders should wholly participate in the value they’ve created and have accelerated vesting if as part of the acquisition transaction they agree to leave the business. If they are staying in the business it’s likely that the new shareholders may want to keep the founder incentivised pursuant to a vesting regime.

While we have addressed “Good Leavers”, there are also scenarios in which it could be justified to have a mechanism to claw-back the vested equity of a founder. This is usually when a founder does something seriously “bad”. For example, commits a criminal offence, acts in a fraudulent or commits a material breach of his / her employment contract. In such scenarios the founder is usually regarded as a “Bad Leaver” and is required to forgo unvested equity and potentially have their vested equity purchased or bought-back by the company (at a discount to market value).

Need Help? Contact Us

If you need assistance with founder vesting arrangements then please feel free to give us a call on 03 8691 3111 or send us an email at hello@alliedlegal.com.au.

You might also like our article What Investors Focus on When Funding Early-Stage Ventures.